Year End Close

The fiscal year 2023 will end on Friday, June 30, 2023.

As in the past, FAS will close the books through a series of steps called "closings." The information below will help FAS successfully close the books.

Closing Steps

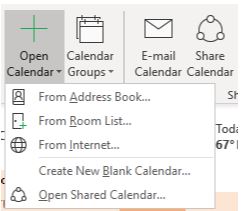

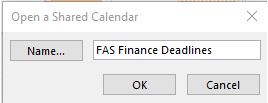

Review University holidays and plan your department's or organization's needs accordingly. Review the Year End Calendar for all FY23 year end deadlines.

Verify that gift, endowment, and unrestricted designated funds are not in deficit at fiscal year end.

* This step is important because funds in deficit as of the final June 30th closing will be charged interest in the following fiscal year. *

It is important that the University recognizes both expenses and revenues in the correct period.

- Process any outstanding reimbursements as soon as possible.

- Process any outstanding invoices as soon as possible.

- Process all AR transactions in a timely manner.

- Run dashboards to verify transactions have been posted accurately.

There are dashboards that are available to help department in year end activities.

Resources

Other Helpful Links

Who to Contact

General Accounting Inbox

Email: fas_accounting@fas.harvard.edu

Nancy Guisinger

Controller

Email: nancy_guisinger@harvard.edu

Christine Boyer

Assistant Controller

Email: christine_boyer@harvard.edu

Devon Losada

Manager of Accounting

Email: dlosada@fas.harvard.edu

Maria Geovanos

Financial and Compliance Analyst

Email: geovanos@fas.harvard.edu

Fabi Theodat

Financial and Compliance Analyst

Email: fabienne_theodat@harvard.edu

Liza David

Staff Accountant

Email: lizadavid@fas.harvard.edu

Linda Kuros

Manager of Endowments and Gifts

Email: l_kuros@harvard.edu

Keith Bitely

Endowment and Gift Administrator

Email: keith_bitely@harvard.edu